Investors interested in opening companies in Estonia will need to keep in mind the fact that their businesses will require professional accounting services. It can be difficult, especially for foreign investors to get acquainted and find their way through the Estonian tax legislation and compliance. Our accountants in Estonia offer professional consultancy and assistance in a wide range of financial services like payroll & related issues, financial consultancy and administration, VAT registration and compliancy as well as audit services.

| Quick Facts | |

|---|---|

| Tax registration support (YES/NO) |

YES, among our accounting services there is also tax registration |

|

VAT registration services (YES/NO)

|

YES, we provide support in VAT registration in Estonia |

|

Payroll and HR assistance (YES/NO)

|

YES, small and large companies can rely on our payroll and HR services |

| Audit services (YES/NO) |

YES, we have auditors who can offer various types of audits in Estonia |

| Bookkeeping services (YES/NO) | Bookeeping is one of our most important accounting services in Estonia |

| Financial statement filing services (YES/NO) |

YES, we provide assistance in filing tax returns and financial statements |

| Accounting services for foreign companies in Estonia (YES/NO) |

We offer accounting services based on the type of entity used (branch or subsidiary) and activities undertaken by foreign companies here |

| Accreditted accountants availability (YES/NO) | YES, our accountants in Estonia are certified |

| Personal income tax rate | The personal income tax is levied at a flat rate of 20% |

| Corporate tax rate | The corporate tax applies at a rate of 20% computed as 20/80 on the taxable income |

| VAT rate | Standard VAT rate in Estonia is 20% |

| Social security contributions |

Social security contributions are paid by employers on the gross income of employees

|

| Access to tax incentives/deductions (YES/NO) | There are no special tax incentives in Estonia |

| Access to double tax treaties (YES/NO) | YES, Estonia has approximately 50 double tax agreements |

| Other services | We also offer tax consultancy and planning solutions, assistance in applying for loans, etc. |

| VAT registration threshold |

– EUR 40,000 for local companies, – EUR 10,000 for intra-community VAT-taxable goods and services |

|

Dividend tax rate |

14%, however, special rules apply in certain cases |

|

Payroll tax rates |

– 20% social security, – 13% health insurance, – 0.8% unemployment insurance |

| Financial statement filing deadlines | 6 months from the end of the financial year |

| Audited financial statement filing required (YES/NO) |

Yes, for large companies meeting specific criteria that can be explained by our accounting company in Estonia. |

| Local representative required (YES/NO) |

A local fiscal agent can be used, but it is not mandatory. |

| Applicable accounting standards |

– Estonian Generally Accepted Accounting Principles (GAAP), – International Financial Reporting Standards (IFRS) |

| Tax minimization/planning advice (YES/NO) |

Yes, we can offer tax minimization and planning support. |

| Types of audits available in Estonia |

– internal, – external, – compliance, etc. |

| Registration as employer/ for employees for social security purposes (YES/NO) | Yes, we can offer employment registration solutions for companies in Estonia. |

| Representation with tax authorities (YES/NO) |

Yes, we can act as liaison with the local tax administration. |

| Tax authorities in Estonia |

– Tax and Customs Board, – Ministry of Finance |

| Support for foreign-owned companies (YES/NO) |

Yes |

| Availability of accounting services for Estonian e-residency holders (YES/NO) |

Yes, we have packages for e-residents. |

| Advantages of working with an Estonian accounting firm |

– online access to our services, – possibility to choose the services needed, – tailored support for foreign businesses, – remote services for e-residents, etc. |

Companies in Estonia spend less time on tax compliance, which is a benefit of the country’s tax system. For instance, corporations in other countries can spend more time to comply with corporate income taxes. Our Estonian accounting company can offer a variety of services that will help you streamline any tax-related matter. Clients that are in need of accounting services in other territories, such as Singapore, can contact our partner accounting firm.

Who can use accounting services in Estonia?

Estonia accounting services imply the use of a specialist in computing taxes and filing tax returns, but also in offering specialized advice on financial matters.

Both natural persons and companies can use the services of an accountant in Estonia, no matter if they are local or foreign. Even if the country’s taxation system is not complicated, complying with filing deadlines and support in obtaining tax incentives and subsidies can be valuable.

If you want to open a company in Estonia and need assistance, our team made of company formation specialists can assist you. One of the first nations to issue bitcoin company licenses, Estonia is a leader in blockchain technology. To engage in business in the following sectors of activity, the crypto license in Estonia for the supply of financial services must be requested for offering virtual currency wallet services and services for converting virtual currencies for fiat currencies.

Services provided by an accountant in Estonia

An accountant can offer a wide range of services, and you can choose one or more of the following:

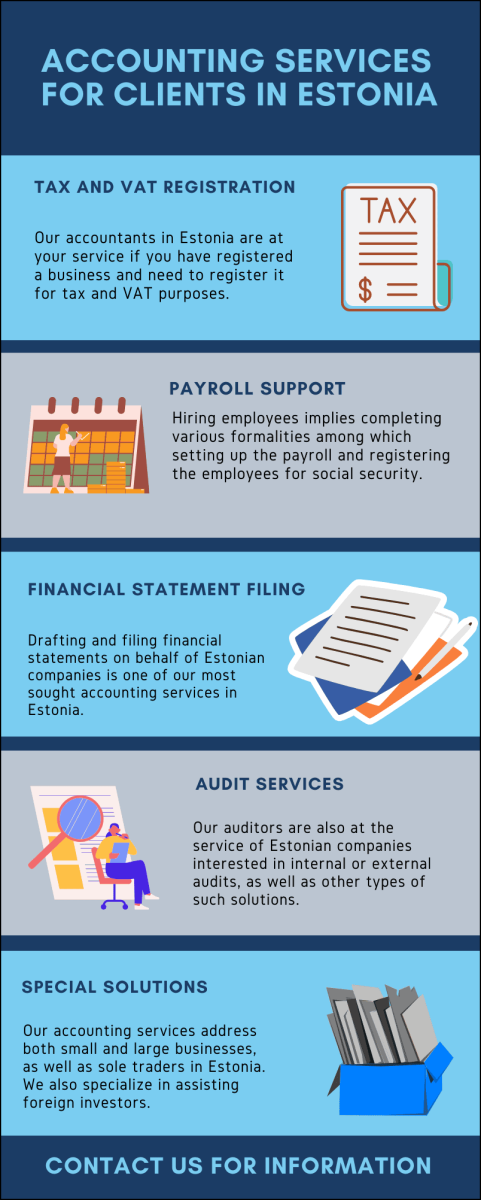

- tax and VAT registration for companies and sole traders in Estonia;

- bookkeeping and accounting services in accordance with the principles adopted by Estonia;

- tax consultancy and planning for companies in order to minimize levies;

- payroll support for companies and other entities with employees in Estonia;

- audit services offered by accredited professionals;

- financial statement drafting and filing services.

If you need guidance in accounting for your Estonian company, our services are tailored to its size and specific. We also have an infographic on our services:

We also provide company registration services for foreign investors in Estonia.

Tax and VAT registration support in Estonia

Our Estonia accounting services start with support in obtaining tax and VAT numbers. While tax registration must be completed upon setting up a business here, as it is part of the incorporation procedure, VAT registration is not mandatory from the beginning of the activities.

Based on a thorough analysis of our Estonian accountants, we will recommend whether you can register for VAT voluntarily or if it is best to wait until the minimum registration threshold is reached.

Our accountant in Estonia has the necessary experience to guide local and foreign investors operating here.

Once these procedures are completed, you can start operating your company with financial guidance from our accountants who can keep the accounting of your business in order to comply with the current legislation.

Bookkeeping and accounting for Estonian companies

While bookkeeping is one of the most strenuous duties of an accountant, accounting implies more complex procedures. This is why many local companies no longer choose to have their own accounting departments but use external services.

An external accountant in Estonia is much cheaper and will usually work faster, as he or she can dedicate the needed time to meet the financial requirements of a company, compared to an internal employee who will usually deal with other matters, such as payroll or HR.

Bookkeeping is one of the most important services an Estonian company can use, as it implies keeping track, registering and maintaining all the invoices and other financial documents in the business. Updating company records and making sure no detail is missed is one of the core services provided by our accountants in Estonia.

When it comes to accounting, accounts payable and receivable are two separate parts that can be handled by our specialists who will work on each of them in order ensure fluidity and correctness when dealing with large numbers of incoming and outgoing invoices, but most importantly when dealing with making, respectively receiving payments.

Using our Estonia accounting services is cheaper compared to hiring a dedicated accountant to deal with a large volume of work and for whom an entire department must be created.

With cost-effective solutions, our experienced accountants will provide tailored services in a manner in which time is essential.

Tax consultancy in Estonia

We welcome all entrepreneurs in need of assistance regarding the financial and accounting policies, flow of documents and financial department organization. If the client is trying to get a loan, we can help him by preparing the necessary documentation. Taxes for company registration in Estonia can also be managed by our accountants.

We can assist in EORI registration in Estonia.

Audit services in Estonia

We can assist in the restatement of annual accounts in accordance with International Financial Reporting Standards (IFRS) applicable in Estonia. Our accountants will examine the evidence supporting the disclosures in the financial statements in order to eliminate all material misstatement and also evaluate the overall financial statement presentation.

Payroll services in Estonia

If the business owner decides to open a company in Estonia and then employ people, he might be needing help with the preparation of payrolls, statements related to salaries and tax files. We can help any entrepreneur with professional services in these matters.

Double Taxation Treaties in Estonia

These are treaties signed by many Governments in order to avoid double taxation of companies activating in more than one country. Any foreign investor entering the Estonian market should work with an experienced and knowledgeable accountant that can provide assistance and representation so that the new business can take advantage of the benefits of double taxation treaties in Estonia.

Tax return filing support in Estonia

In Estonia, one of the main accounting services refers to submitting various tax returns. For small and medium-sized organizations, or SMEs, one of the most significant kinds of businesses in the Estonia market, staying updated or having an accountant handle all these issues, might become critical.

A corporation won’t have to worry about complying with all the financial and filing requirements thanks to the assistance of our accountant in Estonia. Furthermore, all these documents can be filed online, therefore, it is even simpler to rely on us for meeting the filing deadlines.

For businesses that do not need to have their financial accounts audited, our accountants can only manage of financial statements. Private enterprises that have been designated as small businesses are excluded from this rule.

Our experts can address any queries you may have regarding an Estonian company’s accounting. You can get help with a variety of accounting issues from our accounting specialists.

Estonian accounting services for small companies and startups

Our accountant in Estonia stays up with the most recent changes in the commercial landscape, so we customize our services to fit the needs of all kinds of businesses, including small enterprises and startups.

These can benefit from various support scheme, as well as from the corporate tax exemption on reinvested profits. According to it, the profits that are kept and reinvested are not subject to corporate income tax. This means that Estonian resident businesses and foreign businesses’ permanent establishments (including branches) are only liable to a 20% income tax on all distributed profits and a 0% income tax on all reinvested and retained profits (both actual and deemed).

Among the distributed profits are:

- – corporate income dispersed during the tax year;

- – business expenses;

- – gifts, contributions, and representation costs;

- – the transfer of assets from the permanent establishment to the headquarters or other businesses.

The corporate income tax rate on regular profit distributions was also reduced from 20% to 14% starting with January 1, 2018, but only if dividends are given to legal persons. Also, dividends paid to non-residents are no longer subject to any withholding tax. Other payments to non-residents, however, might still be subject to various withholding levies if they don’t have a permanent establishment in Estonia or unless a tax treaty stipulates otherwise.

Support for foreign companies with operations in Estonia

In Estonia, our accounting services also cover the needs of foreign companies operating through subsidiaries, branches, and liaison offices.

Subsidiary companies and branches are treated equally in terms of the tax rates they must pay for their profits under the Estonian tax regulations. As a result, if your foreign firm has a branch in Estonia, you will be required to pay the tax at a rate of 14% for profits, however, only on the income derived in this country. Subsidiaries, on the other hand, are treated as domestic entities and will pay the income tax on their worldwide profits.

Branches are subject to the same wage taxes and VAT regulations as local businesses. Your branch may be liable for particular taxes depending on whether you plan to hire staff and how many. By contacting our accountant in Estonia, you can learn more information regarding the country’s taxation of branches.

With respect to liaison offices, these are not subject to taxes if they are created for marketing purposes. However, parent companies may be required to file various documents related to renting office space and purchasing various equipment they can deduct as business expenses.

Company Management in Estonia

We believe our clients deserve to benefit from customized management strategies that will improve their companies’ financial results and will strengthen its position on the Estonian market. Company management in Estonia can be run smoothly with a little help from knolegeable consultants with expertise in the country’s legislation and accounting policies.

We also have a video on our services:

What you need to know about taxation in Estonia

Our accountant in Estonia is at your service from the very beginning of your operations. This way you can start a long-term confidence-based relationship with someone who knows your business and can provide customized services.

Our specialists are accredited by the Estonian associations of accounting and audits.

From a taxation point of view, the Estonian Tax and Customs Board disposes the following:

- – Estonia levies taxes only on distributed profits of companies at the rate of 20%;

- – a 14% rate is available for dividends paid to other companies;

- – the VAT registration threshold is set at 40,000 euros;

- – the standard rate of the VAT is 20%, however, a lower rate of 9% applies to certain goods (medical products, books and newspapers, accommodation);

- – there is also a 0% VAT rate applied to exports, intra-community supply of products, and international transport of persons.

By choosing our accounting services in Estonia, our clients can reduce their expenses and be able to control their business in an efficient manner without spending much time. They can rely on us for confidentiality and high standard services. We do our best to understand each business and provide best personalized advices for all types of companies in Estonia. Please contact our company formation specialists in Estonia for more detailed information and personalized consultancy.

That is why our company can provide the help every entrepreneur needs for hassle-free relationship with the Tax Authorities in Estonia and a smooth management of his business.