Estonia’s access to the EU came with simplified customs procedures which require companies established in this country to obtain EORI numbers. EORI stands for Economic Operators Registration Identification and was introduced in 2009 as a replacement of the Trader’s Unique Reference Number (TURN) system. Individuals and companies engaging in customs operations on Estonian territory are required to apply for EORI numbers. We can assist EU and non-EU entities interested in obtaining Estonian EORI numbers.

Below, our company formation specialists in Estonia explain how EORI registration is completed in this country.

| Quick Facts | |

|---|---|

| Applicability of the EORI system |

The EORI system applies at EU level, |

| Types of businesses required to register for EORI in Estonia | Local and foreign enterprises involved in import-export activities on EU territory must obtain EORI numbers |

| Documents required for EORI registration in Estonia | Information about the company, the VAT number (it is mandatory to register for VAT in order to obtain an EORI number), and the application form must be filed to register for this system |

| Authority in charge of issuing EORI numbers |

The Estonian Tax and Customs Board |

| Possibility to obtain EORI numbers online |

YES, the procedure can be completed online |

| Possibility for individuals to register for EORI |

YES, private citizens are required to register for EORI if they acquire or sell goods from other EU states |

| VAT registration requirement (YES/NO) | YES, VAT registration must be completed before applying for an EORI number |

| Format of the EORI number | Country code EE followed by business number (for local companies), personal number (for private individuals), non-resident registration number (for foreign citizens) |

| EORI registration for Estonian subsidiaries of foreign companies | Subsidiary companies must apply for their own EORI numbers in Estonia |

| EORI registration for Estonian branches or foreign entities | EORI registration on behalf of Estonian branches must be completed by the parent companies |

| Timeframe to obtain an EORI number In Estonia (approx.) | The EORI number is issued in approx. 5 business days |

| Validity or EORI numbers | EORI numbers do not have an expiration date |

| De-registration from the EORI system | Company liquidation and voluntary de-registration are the main reasons to give up an EORI number |

| Re-registration requirements for EORI |

Re-registration is possible. The same EORI number |

| Support in EORI registration (YES/NO) | YES, we offer support in EORI registration for local and foreign companies |

EORI number requirements in Estonia

The EORI system became mandatory in 2010 in this country and ever since all companies involved in import-export activities required EORI registration in Estonia. The main important aspects to consider when it comes to registering for EORI is that this is a mandatory requirement for:

- – individuals (natural persons);

- – sole traders;

- – local companies;

- – EU-based companies;

- – non-EU based companies.

Estonia EORI registration must be completed upon the first interaction with the customs authorities in the case of local entities and citizens. EU companies will obtain their EORI numbers with their home country customs, while foreign companies can apply for EORI registration with the Estonian authorities if this is the first country in the EU they engage in customs activities with.

The main advantage of EORI registration is that no matter the country of provenience of the applicant, the procedure is the same.

In the case of Estonian citizens or residents and companies with management or legal seats here the procedure is completed in a very short period of time.

If you want to open a company in Estonia and are also considering obtaining an EORI number, our local representatives can assist you with both operations.

If you wish to apply for a crypto license in Estonia, you may rely on our company registration consultants. Although the process is quite straightforward, it is quite common for businesspersons to use specialized services to simplify things. Do not hesitate to contact us for advice if you are considering such a business venture!

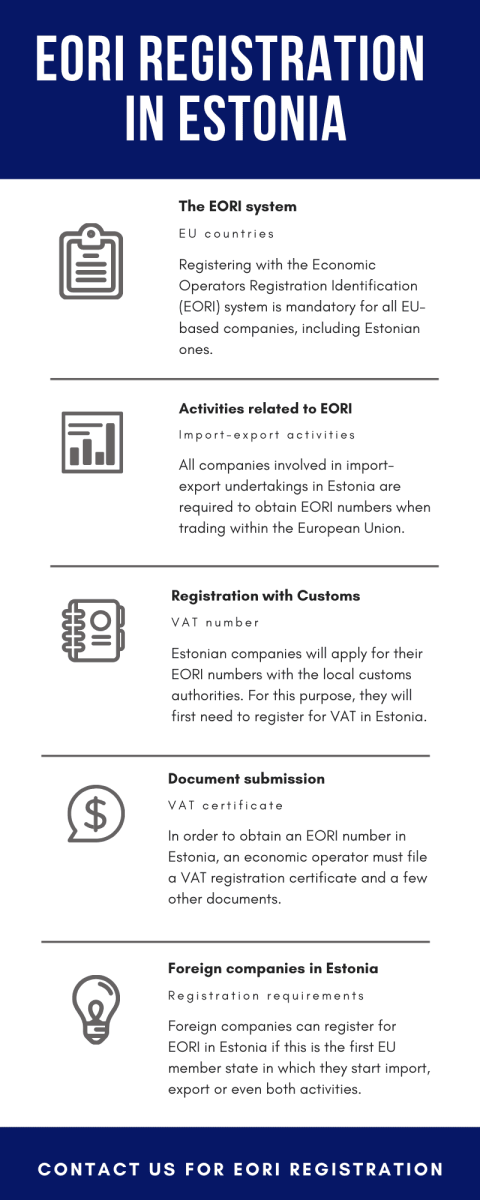

We invite you to read about EORI registration in Estonia in the scheme below:

Documents required for EORI registration in Estonia in 2024

The documents required when applying for an EORI number in 2024 are the same for both Estonian and foreign entities, the main requirement being for the entity to have a VAT number. In other words, a company must be registered for VAT in Estonia or its home country in order to be able to access the EORI system.

The following documents must be filed with the Estonian Tax and Customs Board in order to obtain EORI numbers:

- the application form issued by the Board (it should be noted all forms are issued in Estonian);

- a copy of the identification document of the person applying for the EORI number;

- a document indicating the identification data of the company (the VAT number is mandatory);

- holders of TIR Carnets must also submit a copy of their carnets with the Estonian authorities;

- other documents could be required for non-EU companies applying for EORI via email.

As mentioned above, all documents released by the authorities here are in Estonian, which is why if you are a representative of a foreign company you can rely on our company registration agents in Estonia for help in completing all the formalities.

Appointing a representative for EORI registration in Estonia

Business owners do not need to apply in person for EORI numbers in Estonia, as they can appoint representatives to act on their behalf. Apart from the documents mentioned above, a power of attorney and identification papers of the representative will be required. The procedure will then be completed the same way as if the owner requests the number. Applications for registering for EORI in Estonia are filed via email for local and foreign operators.

The issuance of Estonian EORI numbers is completed in a matter of days for both local and foreign economic operators.

The VAT number as part of EORI registration in Estonia

Registering for VAT is a mandatory condition to obtain an EORI number in Estonia in 2024, therefore, no matter if a business or natural person has made taxable supplies that meet the mandatory registration threshold or not, will be required to apply for a VAT number before requesting the EORI number.

We remind investors that if they want to open trading companies in Estonia, they can rely on us for complete assistance in obtaining the necessary licenses for their activities. These include VAT and EORI registration.

Our accountants in Estonia can help regional businesses respect all accounting regulations. A wide range of services, including audit, bookkeeping and payroll are available for clients. Business owners can keep a clear picture of the financial situation of their companies with the help of our accounting firm which can offer personalized services.

Foreign operators applying for EORI registration in Estonia

EORI registration is not required for companies and natural persons acting as economic operators and located in the European Union alone, but also to foreign companies and sole traders or other business forms from non-EU countries. In their situation, the procedure must be completed prior to arriving to the EU. A foreign economic operator can apply for an EORI number in Estonia if this is the first EU country it trades in.

Subsidiaries are recognized as domestic corporations and are required to apply for their own EORI numbers, therefore things are rather straightforward in this scenario.

Branch offices may be established by either non-EU corporations that can or cannot obtain EORI numbers, or by EU companies (in which case there is a good possibility that the parent companies already have EORI numbers). Branch offices are not permitted to submit their own EORI registration applications, as the parent firm must do it. Alternatively, a branch office can use the same EORI code as the parent company.

An economic operator registered in Estonia will have an EORI number that is based on both its VAT number and the country code of the state in which it registered for EORI. Then, as this number is special and usable across the full territory of the European Union, there is no need to apply for a different one. All customs officials in member states will recognize the appropriate number after it has been entered into the system.

There are instances where businesses are sold or combined with others while already having an EORI number. There are two circumstances that can apply in this case:

- the instance when the acquired firm retains its own legal identity, requiring the use of the prior EORI number;

- the case where the merged company is absorbed by the other business, requiring the use of the subsequent EORI number.

If an Estonian economic operator is unsure whether EORI registration has been completed, they can quickly check the current EORI database.

It is also worth noting that the information in the EORI system is not automatically updated when personal and/or contact information is modified in the business register, population registry, or, in the event of a non-resident, the tax obligation register. The legal entity’s representative must have an account on the Estonian Customs Board’s website to update the data in the EORI system themselves.

The documents required for EORI registration for non-EU operators are the same as for EU-based traders, therefore there is no need to complete other additional steps to obtain this number. Just like in the case of local operators, foreign ones need to register for VAT in their home countries before applying for EORI numbers in Estonia. However, it is important to note that the number issued will start with Estonia country code, EE, and will be available and recognized by all other member states.

The documents required to register for EORI in Estonia can be sent via email and the number is issued within a matter of days.

Our Estonian company formation consultants can guide foreign investors who want to apply for EORI numbers here.

Activities associated with EORI numbers in Estonia

Obtaining an EORI number has many advantages for Estonian companies which will benefit from streamlined customs procedures within the EU, but also for the local customs authorities which will be able to process and obtain information about traders in a fast manner.

There are various activities which can be completed based on EORI number and among these we mention the following:

- – filing of various customs declarations with the Estonian and other EU customs authorities;

- – filing of Entry Summary Declarations and Single Administrative Documents (SAD) declarations;

- – filing of temporary storage declarations and warehousing declarations for such activities;

- – acting as carriers for transporting goods by sea, air or land within the EU territory;

- – receiving various notifications and information from other EU customs offices.

Our company formation consultants can offer more information on the activities to be completed based on EORI numbers. They can also help you if you are planning on starting a business in Estonia, including in the fintech sector. The popularity of cryptocurrencies aligns with Estonia’s reputation as a digital success story, making Estonia one of the hubs for bitcoin businesses in Europe. This industry has had extraordinary growth, and investors are highly interested in any solutions involving blockchain technology. If you want to start such a business, you need to consider applying for a crypto license in Estonia.

Importing and exporting in Estonia based on the EORI system in 2024

One of the main reasons the EORI system was introduced at the level of EU is to simplify the import-export and customs procedures companies needed to go through when entering the European Community.

Even if the EORI number can be used for completing various actions, most Estonian companies and foreign ones take advantage and use it when importing or exporting goods into/outside Estonia. With the EORI number, the procedure is simplified a lot by the need to submit fewer documents when the products are originated in another EU country.

It should be noted that when importing goods from non-EU countries, specific licenses, including import permits are required. Apart from these, documentation related to the transportation and origin of the goods is required.

Among the papers that need to be filed with the Estonian Customs Board when importing certain goods are:

- – the Single Administrative Document (SAD);

- – invoices and documents which must be completed in accordance with the EU’s Customs Code

- – certificates of origin, packaging list, etc.

When importing food products of animal origin, firearms, tobacco and cigarettes, special conditions apply.

If you need information on the documents to prepare alongside the EORI number for importing special categories of goods, you can ask for information from our company registration agents in Estonia.

The importance of EORI registration in Estonia in 2024

Obtaining an EORI number in Estonia in 2024 can be very important for companies completing trading activities within EU borders on a regular basis. Apart from benefiting from simplified customos procedures, this number never expires unless a business applies for de-registraiton.

At the level of 2024, Estonian EORI registration requirements are the same for any company no matter its country of origin, including for businesses from Asian states, for example, as all these need are VAT numbers.

For details on EORI registration and starting a business in Estonia in 2024, feel free to consult with our specialists.

De-registration from EORI in Estonia

It is possible to de-register from the EORI system in Estonia voluntarily, if a company ceases its trading activities or if it terminates its activities for good and is also de-registered from the Trade Registrar. Foreign companies can also renounce the EORI number, however it is important to understand that they can come back and reapply for it. The former EORI number will be reassigned. The EORI number has no expiration date.

Another important thing to consider is economic operators can have their data and EORI numbers published with the European Commission with the purpose of easing the interaction with all EU states’ customs authorities.

If you want to open a company in Estonia, do not doubt in asking for our support.

The EORI system in Estonia

In order to streamline customs operations at the EU level, the European Commission introduced the Economic Operator Registration Identification, or EORI, in 2009. Even while it was aimed at firms from EU member states, it also became a need for organizations registered in non-EU nations that needed to conduct import and/or export operations within the EU.

The Trader’s Unique Reference Number (TURN), which was out of date, had to be replaced, and EORI was created. The new system also allowed for quicker customs operations, requiring significantly fewer documentation (with regard to particular products), and shortening the total amount of time spent with customs.

As part of the EU, Estonia also uses this system for domestic and foreign companies operating here.

The simplest business structure available in Estonia is the sole proprietorship, and individuals acting as proprietors are eligible to participate in cross-border import-export activities that may require EORI numbers. The EORI registration process is as straightforward as it is for businesses, and all that is required is an application form that is properly filled out and submitted to the customs department in the nation where goods are exported.

A natural person who manages their business, as well as every partnership, limited corporation, and other entity that imports or exports goods, all fall under the category of an economic entity. When conducting business outside of the European Union and intending to import or export goods, each economic entity is required to submit a report to the EORI system.

For foreign businesses who operate here through branches and subsidiaries, Estonia is a desirable location. When it comes to EORI registration in their situation, there are a number of factors to take into account. Here is also a video on this topic:

Trading in Estonia

Estonia is a very prolific economy within the European Union and trading is one of the most important supporters of the economy. According to recent data:

- – October 2023 saw a total of EUR 1.5 billion in exports;

- – the same month a total of EUR 1.8 billion in imports of goods entered Estonia;

- – exports have dropped by 21% and imports by 17% from October 2022;

- – in October, Estonia’s trade imbalance was EUR 307 million, up EUR 24 million from the same month last year;

- – in August, September, and October, exports totalled EUR1.5 billion, continuing at a similar level;

- – in October, the primary goods shipped from Estonia were transport equipment (11%), agricultural products and foodstuff (12%), and electrical equipment (15% of overall exports);

- – the largest decline, of EUR158 million, was seen in the exports of mineral goods;

- – exports of wood and wood-related commodities, food preparations, and agricultural products fell by EUR 80 million and EUR 55 million, respectively.

For assistance in EORI registration in Estonia, please contact our local representatives.